Discount retailers Aldi and Lidl continue to press ahead with their ambitious growth plans, with the two combining for a total of 128 planning applications submitted for new stores across the UK in 2017.

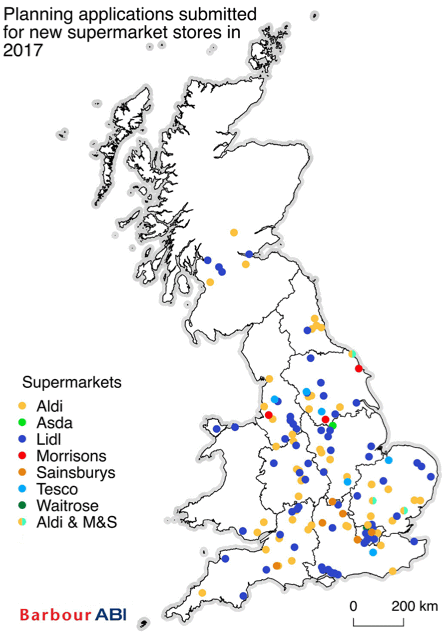

According to data from industry analysts Barbour ABI, Lidl submitted 68 planning applications for new stores last year, followed closely by Aldi with 60. The traditional ‘Big Four’ lagged behind with a meagre total of 20 planning applications (Tesco eight, Sainsbury’s seven, Morrison’s four and Asda one). Property cost issues and an excess of floor space from larger stores has contributed to the scaling back from the ‘Big Four’.

The applications submitted are predominantly for smaller convenience stores, looking to satisfy demand and tapping into the growing common consumer habit of more frequent trips to local, convenient stores. The planning applications from Aldi, Lidl and the ‘Big Four’ shows that the majority of the few plans for larger stores came with extra units for other retailers, café’s, petrol stations and leisure opportunities.

Whilst the ‘Big Four’ have seen little growth in its shop floorspace over recent years, 2017 was a year of scaling back for the ambitious Aldi and Lidl, in comparison to its space hungry years of recent memory such as 2015, where it submitted a combined total of 205 planning applications for new stores.

Commenting on the figures, Michael Dall, Lead Economist at Barbour ABI, said: “The discount retailers continue to dominate the supermarket space race even if they’re not as active as 2015, which saw them commit to rapid expansion. Their appetite for investment matches their highly ambitious growth plans as they continue to challenge the established order in the supermarket sector.”